Why a Single Click Can Devastate Your Bank Account

How One Click Can Cost You $10,000 (and How to Stop It) – real story is not just a cautionary tale. A firefighter lost nearly $500,000 in crypto from a fake security prompt. A business owner faced an $8,000 cloud bill from one line of buggy code. These aren’t rare events; they’re the new normal.

Here’s the quick answer:

- The “$1 Fee” Trap: Fake delivery texts lead to sites that steal your bank details. Victims lose thousands in hours.

- Cloud Cost Disasters: Simple misconfigurations or bugs can generate massive, unexpected charges.

- Phishing Sophistication: Criminals use legitimate-looking forms, spoofed numbers, and fake alerts to trick savvy users.

- The Real Cost: Beyond money, victims face identity theft, canceled services, and emotional distress.

- The Solution: Verify first, recognize red flags, use strong security, monitor costs, and stay informed.

Scammers exploit technology faster than most can keep up, but you don’t need to be a cybersecurity expert to protect yourself. Understanding their tactics is the first step.

This article will walk you through real stories, decode scammers’ tactics, and provide five practical steps for your protection. These lessons could save you thousands of dollars and immense stress.

The Real Stories: How One Click Can Cost You $10,000 (and How to Stop It)

The idea that How One Click Can Cost You $10,000 (and How to Stop It) can be your reality is unsettling. These disasters happen to regular people and businesses daily, causing not just financial loss but severe emotional distress. Let’s look at how quickly things can go wrong.

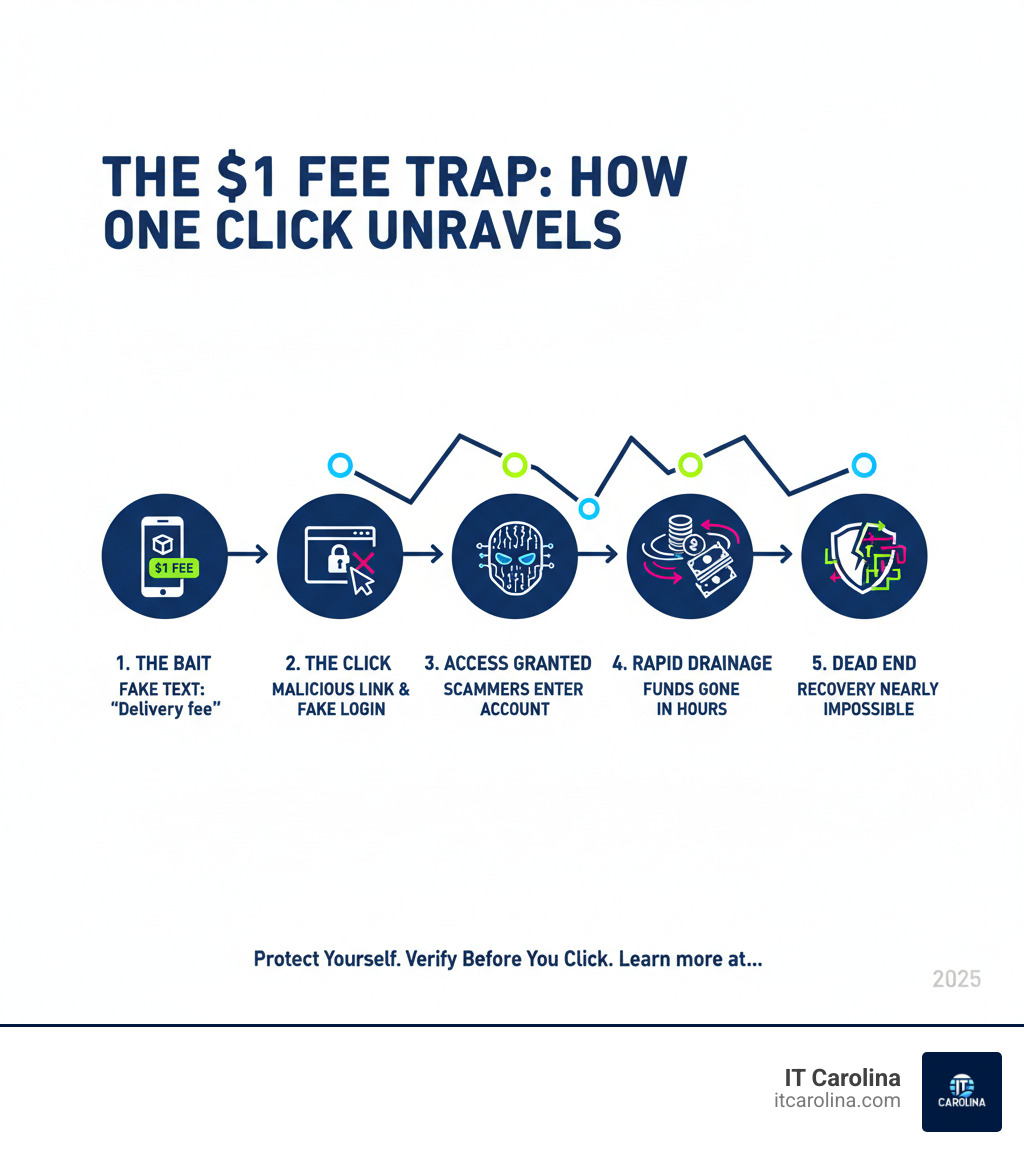

The “$1 Fee” Phishing Trap

Your phone buzzes with a text about a package delivery requiring a small £1 fee. It seems reasonable, so you tap the link. That single tap is all it takes.

The link leads to a website that looks perfect—the logo, the colors, everything feels legitimate. According to fraud experts, these incredibly sophisticated fake websites make it “alarmingly easy to fall into the trap.”

You enter your bank details to pay the £1. Within minutes, scammers have what they need. They don’t stop at £1; they drain your account with multiple transfers before you realize anything is wrong. Victims have lost their entire savings in hours.

These messages create urgency, warning your parcel will be “returned to sender” if you don’t act. It’s psychological manipulation designed to make you act before you think.

The Cloud Cost Catastrophe: A Small Business Nightmare

Small businesses face equally terrifying scenarios. The company screen.studio found a bug in their software that caused their app to download a 250MB auto-update file every 5 minutes for every user.

The bug generated 9 million downloads and over 2 petabytes of data traffic on Google Cloud. Their typical monthly bill of around $300 skyrocketed to an estimated $8,000, with the potential to hit $10,000. You can read the painful details in their post about one line of code that did cost $8,000.

The scariest part? They had no cost alerts set up, so they were blindsided by the massive bill.

A similar nightmare happened to a developer whose AWS S3 bucket, given a generic name, was hit with nearly 100 million unauthorized requests in a single day, resulting in a bill over $1,300. An open-source tool happened to use the same generic name as its default backup location.

These examples show that a financial catastrophe doesn’t require a malicious link. A simple configuration mistake or a small bug can cause costs to spiral out of control.

Decoding the Deception: Common Tactics of Online Scammers

To understand How One Click Can Cost You $10,000 (and How to Stop It) – real story, you need to know how scammers operate. They are professionals who use a combination of psychological manipulation and technical tricks to bypass your rational thinking.

The Psychology of the Scam: Pressure, Fear, and Greed

Scammers are excellent psychologists who hack your emotions. Every successful scam relies on triggering urgency, fear, or greed.

Urgency and pressure are a scammer’s best friends. The delivery fee text warns your package will be “returned” to make you act immediately, short-circuiting your skepticism.

Fear of loss is equally powerful. The firefighter who lost $500,000 was told his account was being accessed from Germany. Impersonating the FTC, a bank’s fraud department, or another authority figure creates fear and demands compliance.

Greed and hope promise something for nothing. Scammers impersonate lottery winners on social media, offering a share of their winnings. Remember: real prizes are free. Anyone asking for “taxes” or “fees” upfront is a scammer. The legitimate Publishers Clearing House will never ask you to pay to receive a prize.

The Technology of the Scam: Phishing, Spoofing, and Fraud

Psychology lowers your guard, but technology steals your money.

Fake websites and phishing links are frighteningly convincing. These sophisticated scams use pixel-perfect copies of legitimate sites with URLs that are just one letter off. One click can hand over your login credentials.

Email and caller ID spoofing make scams look official. Scammers can make a call appear to come from your bank’s real number or send an email from a legitimate-looking address, like through Google Forms. This technique, called spoofing, lowers your natural defenses.

Click fraud drains business ad budgets by using bots or click farms to generate fake clicks on online ads. This inflates traffic statistics and forces businesses to pay for nonexistent customers. The problem worsened during the pandemic as ad budgets shifted online, as detailed in How the COVID-19 pandemic affected click fraud.

Understanding these tactics makes them easier to spot. For more tips, see our guide on Essential Online Security Tips for Everyone.

Your 5-Step Defense Plan Against Costly Clicks

A proactive approach is the best defense. Here are five practical steps to build strong digital habits and keep you safe.

1. Develop a “Verify First” Mindset

Our mantra should be: verify before you click, verify before you act.

- Be Skeptical of Unsolicited Messages: If you weren’t expecting an email, text, or social media post, treat it with caution, especially if it promises money or threatens consequences.

- Check URLs Carefully: Hover over links (desktop) or long-press (mobile) to see the actual URL. Look for misspellings or unusual domains. If a PCH link isn’t

pch.com, it’s fake. - Use Official Contact Information: If you get a suspicious message, don’t use the contact details provided. Find the company’s official website or phone number yourself and verify the request. This is vital for businesses, as detailed in our Cybersecurity Tips for Small Businesses: Protect Your Data.

2. Recognize the Red Flags of a Scam

Scammers leave clues. These red flags should raise your suspicion:

- Unexpected Payment Requests: Real prizes are free. If you’re asked to pay for “taxes” or “shipping” to get a prize, it’s a scam.

- Pressure to Act Now: Scammers create false urgency with “limited time offers” or threats to bypass your critical thinking.

- Specific, Untraceable Payment Methods: Scammers insist on wire transfers, payment apps (CashApp, Zelle), gift cards, or cryptocurrency because they are “difficult to trace and recover.” This is a huge red flag.

- Poor Grammar or Generic Greetings: Many scams still contain spelling errors or use greetings like “Dear Customer” instead of your name.

3. Fortify Your Digital Life

Strong digital security starts with a solid foundation.

- Strong Passwords and Multi-Factor Authentication (MFA): Use a unique, complex passphrase for every account and a password manager to track them. Enable MFA on all critical accounts (email, banking). Physical security keys offer the best phishing resistance. A Password Manager for Business is essential for companies.

- Keep Software Updated: Updates contain critical security patches. Keep your OS, browsers, and apps up to date.

- Use Reputable Antivirus Software: This is your first line of defense against malware. Run regular scans. Our guide on How to Detect and Fight Computer Viruses can help.

4. For Businesses: Implement Cost Controls & Monitoring

The cloud is a great tool, but it can become a financial black hole without proper management.

- Cloud Cost Alerts: If you use AWS or Google Cloud, setting up cost alerts is non-negotiable. Configure them to notify you when spending hits certain thresholds.

- Network Traffic Monitoring: Regularly monitor network traffic for anomalies that could signal a bug or an attack.

- Employee Training: Train your team to recognize phishing and other threats. This is a key part of the 5 Cybersecurity Habits Every Small Business Must Adopt.

- Click Fraud Prevention: If you use online ads, use click fraud prevention software to protect your budget from fake clicks.

5. Stay Informed and Share Your Knowledge: How to Stop It

Scams are always evolving. Staying informed is crucial.

- Stay Updated on Current Scams: Follow reputable cybersecurity blogs and consumer protection agencies like the FTC.

- Share What You Know: People who know about scams are better at spotting them. Talk to friends and family. The FTC’s Pass It On program encourages this community awareness.

Damage Control: What to Do If You’ve Already Clicked

If you’ve clicked a suspicious link or given out information, don’t panic. How One Click Can Cost You $10,000 (and How to Stop It) – real story doesn’t have to be your story. Acting quickly is critical to limiting the damage. Here’s what to do right now.

Step 1: Secure Your Finances Immediately

Every second counts. Scammers work fast, so you need to move faster.

Call your bank’s fraud department immediately. Do this for every financial institution you use—banks, credit card companies, investment accounts. Tell them what happened. They can freeze accounts, cancel cards, and start an investigation.

Ask them to issue new cards and account numbers. It’s an inconvenience, but it’s better than losing your savings. Request fraud alerts on your accounts to monitor for suspicious activity.

Set up transaction alerts. Most banks can text or email you for every transaction. This real-time monitoring helps you spot fraud within minutes, not days later.

Step 2: Lock Down Your Digital Identity

A compromised account can be a gateway to your entire digital life. Scammers want your email, social media, and shopping accounts.

Change your passwords, starting with your email. Your email is the master key; if scammers control it, they can reset other passwords. Change it first, then move on to banking, social media, and other important accounts. Use a password manager to create and store strong, unique passwords.

Run a full malware scan on your devices. Use reputable antivirus software to run a complete scan on the computer or phone you were using. Malware can log keystrokes and steal data in the background. Our guide on How to Detect and Fight Computer Viruses can walk you through this.

Check if your personal information has been leaked. Your data could be on the dark web. Use a service to check for your information in known data breaches. Our article Has My Data Been Leaked? How to Check and What to Do explains how.

Step 3: Report the Crime to the Authorities

Reporting scams helps law enforcement track criminals and protects others. Your report could be a crucial piece of a larger investigation.

File a report with the Federal Trade Commission (FTC) at ReportFraud.ftc.gov. This is the most important step. The FTC uses this data to identify patterns and shut down scam operations.

Contact your local police department. An official police report creates a paper trail that is often required by banks and credit card companies to dispute fraudulent charges.

Report to specialized agencies. If the scam came via mail, report it to the U.S. Postal Inspection Service. If your identity was stolen, visit IdentityTheft.gov for a comprehensive recovery plan.

Frequently Asked Questions about Online Scams

Why do scammers demand payment with gift cards, wire transfers, or crypto?

Because these payment methods are nearly impossible to trace or reverse. Think of them as digital cash. Once you send the money or provide the gift card code, it’s gone for good. Legitimate businesses and government agencies will never demand payment this way. If someone insists on these methods, it’s a scam.

Can a single click really install malware on my computer?

Yes, through a method called a “drive-by download.” A single click on a malicious link can exploit a security vulnerability in your web browser or other software to install malware on your device without any further action from you. The malware could be ransomware, spyware, or a keylogger that steals your passwords.

This is why keeping all your software updated and using robust antivirus protection is so critical. If you notice strange behavior, our guide on Common Computer Problems and Solutions Every User Should Know can help.

Are prize giveaways from companies like Publishers Clearing House (PCH) always scams?

No, and that’s what makes impersonation scams so tricky. PCH is a legitimate company that has awarded “more than half a billion dollars in prize money.” However, scammers love to impersonate them.

Here’s how to spot the fake:

- The real PCH will never ask you to pay a fee or cover taxes to receive your winnings. Real prizes are free.

- PCH does not notify major prize winners by phone, text, or email. As they state, “Publishers Clearing House never calls, texts, emails, or messages winners” in advance. Winners of $10,000 or more are notified in person by the Prize Patrol or via certified mail.

- Scammers often send fake checks and ask you to wire money back for “fees.” The check will bounce, but only after your money is gone.

If you’re unsure, contact PCH directly through their official website or customer service number (800-566-4724). You can also check How PCH notifies winners on their official site.

Conclusion

The stories are sobering: huge financial losses from a single click. These aren’t distant horror stories; they’re happening to people just like us. But the good news is that How One Click Can Cost You $10,000 (and How to Stop It) – real story doesn’t have to be your story.

You now know how these scams work and how to spot the red flags. You have a practical, five-step defense plan:

- Verify first.

- Recognize red flags.

- Fortify your digital life.

- Implement cost controls (for businesses).

- Stay informed and share your knowledge.

Even if you make a mistake, acting quickly to secure your finances, lock down your identity, and report the crime can make all the difference.

At IT Carolina, we’ve seen how devastating these threats can be for Charlotte families and small businesses. We’re passionate about providing friendly, jargon-free IT support that makes sense. With our transparent flat-rate pricing and quick local service, we’re here to help you steer these challenges without the stress.

Your peace of mind matters. Whether you need help securing your home network, protecting your small business, or recovering from a security incident, we’re here to help.

Get expert Charlotte tech support